What really drives me insane about the debt ceiling debate and discussions about cutting spending when the economy is in the tank is the politicians in DC ignoring the people who actually do economics as a job. Paul Ryan’s budget, Obama’s grand bargain, and the final deal all ignore the economic facts. Recently a tea party Republican was schooled by the Congressional Budget Office and I think all cheap labor conservatives need to read the detail of the event.

I had the following conversation with a conservative friend of mine recently:

My friend: funny how the folks who have been in congress for 20+ years want to blame those who have been there for just 8 months for the debt & budget problems

Me: Having anti-Intellectuals in office was quirky when it was only Bush Jr. and Sarah Palin but now we have people like Eric Cantor and Paul Ryan who ignore those who have actual training in economics and that led to the gas bomb that led to the downgrade. We can’t afford stupidity any more – real people will get hurt. It is time to start working for America instead of trying to trash it like the Tea Party people are doing. I mean you can’t lead a government if it doesn’t exist right? Ohhhhhhh…..

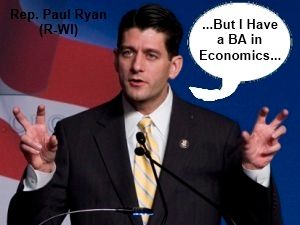

My friend: hhhmmm…interesting…Paul Ryan has a B.A. in economics & political science from Miami University.

Paul Ryan may have a degree but it’s obvious he didn’t learn anything about economics.

Rep. Tim Huelskamp (R-KS) is in the same boat. He asked the Congressional Budget Office (CBO) two questions: What current federal departments, agencies, programs, or portions thereof do not contribute to economic growth? and In the programs that CBO believes do contribute to economic growth, what level of spending cuts would amount to a level you believe would be significant enough to “probably slow the economic recovery”?

The CBO response echoed economists that the Tea Party Republicans and even President Obama have ignored during this whole debate:

“When demand for goods and services falls short of the economy’s ability to produce them, as is the case currently, increasing government spending can increase aggregate demand and thereby narrow the gap between the economy’s actual and potential levels of output,” Elmendorf writes.

The precise details matter. The more robust the economy, the lower the impact. But, according to Elmendorf, “when the Federal Reserve’s ability to lower short-run interest rates is constrained because those rates are already near zero, as they are currently, the short-run effects of changes in government spending on output tend to be larger than usual.”

“Some types of spending, such as funding for improvements to roads and highways, may add to the economy’s potential output in much the same way that private capital investment does,” Elmendorf writes. “Other policies, such as funding for grants to increase access to college education may raise long-term productivity by enhancing people’s skills. The positive longer-term impact of deficit reduction on GNP would be smaller if the policies that reduced deficits included cuts in productive government investments.”

Cut And Grow Fail: CBO Schools Tea Party Freshman In Basic Economics

Again, at this time, in this current economy, we DON’T have a spending problem and cutting further will HURT the recovery.

…But Paul Ryan has a BA in economics…

*sigh*

Rep. Paul Ryan (R-WI), May 17, 2011: “You want to make sure that the bondholder has confidence that the government’s going to be able to pay them…. That’s what I’m hearing from most people, which is if a bondholder misses a payment for a day or two or three or four what is more important that you’re putting the government in a materially better position to be able to pay their bonds later on.”

“[P]eople in the political arena were even talking about a potential default,” said Joydeep Mukherji, senior director at S&P. “That a country even has such voices, albeit a minority, is something notable,” he added. “This kind of rhetoric is not common amongst AAA sovereigns.”

Economist Paul Krugman writes:

For the fact is that right now the economy desperately needs a short-run fix. When you’re bleeding profusely from an open wound, you want a doctor who binds that wound up, not a doctor who lectures you on the importance of maintaining a healthy lifestyle as you get older. When millions of willing and able workers are unemployed, and economic potential is going to waste to the tune of almost $1 trillion a year, you want policy makers who work on a fast recovery, not people who lecture you on the need for long-run fiscal sustainability.

Unfortunately, giving lectures on long-run fiscal sustainability is a fashionable Washington pastime; it’s what people who want to sound serious do to demonstrate their seriousness. So when the crisis struck and led to big budget deficits — because that’s what happens when the economy shrinks and revenue plunges — many members of our policy elite were all too eager to seize on those deficits as an excuse to change the subject from jobs to their favorite hobbyhorse. And the economy continued to bleed.

What would a real response to our problems involve? First of all, it would involve more, not less, government spending for the time being — with mass unemployment and incredibly low borrowing costs, we should be rebuilding our schools, our roads, our water systems and more. It would involve aggressive moves to reduce household debt via mortgage forgiveness and refinancing. And it would involve an all-out effort by the Federal Reserve to get the economy moving, with the deliberate goal of generating higher inflation to help alleviate debt problems.

I wonder if Miami of Ohio will want Ryan’s degree back?